News

2019 FDIC Report on the Unbanked

With new data mining technology the FDIC in NOT using, we are able to say confidently that 176 Million people are now considered to be Bank Challenged™!

The 2016 FDIC Study FAILS to count children living at home with at least one banked adult…

There are 81 million people considered to be “banked” in America…. That’s ANOTHER 81 million children left out to the FDIC Study…

If you want to argue that 110 Million people are banked… you’re about to add 29 million children to the numbers!

Argue that some of these 110 Million children are minors… OK fine

Let’s rebut that with, 1.4 kids live at home…

Then let’s agree that at least 50 Million non minors still live at home… those 18 years and older…

Then agree to support that 50 Million figure w the now 81 Million Millennials that are now 18+ years of age….

That studies show, shun traditional banking… and agree that 31 Million Millennials are banked.

Agreeing to settle on at least 50 Million people out of the 81 Million not counted, should be counted as “unbanked”!

Check Cashing locations have now roughly 30,000 locations. A GROWTH OF 30% since 2000.

EACH FiSCA location, for example, has an AVERAGE of 2300 customers.

[FiSCA, Financial Service Centers of America.. that are anything but…]

The other 30,000 locations are non FiSCA franchises.

That’s 60,000 NON bank locations… why can’t the Banks and Credit Unions run 60,000 REAL Financial Service Centers?

Deposit & GO InstaDebit® allows for just that solution!

The 5.4% “unbanked”, as reported by the 2019 FDIC Study does not accurately represent 69 million people.

A 2017 report forecasts the AFS (Alternative Financial Services) market to be worth $324 Billion….

5.4% Unbanked could NOT possibly sustain the $324 Billion figure!

Again here we are 4 years later…

The Oct 2020 Economic Innovation Group (EIG) Report, based on results crunched since 2018, show without a doubt, a steady growth rate of Unbanked / Underbanked people and communities since their 2000 Report!

To now encompass a Distressed Communities Index (DCI) of Zip Codes virtually covering HALF of every State!

See the Red and Orange Zip Code covered maps!!!

Here; http://seetekcorp.com/bank-deserts.php

And Here on the EIG Site; https://eig.org/dci/interactive-map

EIG further reports that individual minority groups count for 10 to 25% of the unbanked population...

NOT included in any FDIC Report and seldom mentioned in any other report is the 2005 US Gov Report claiming that 11 Million undocumented workers live in the United States… a figure today thought to be more like 40 Million undocumented people… yes some of them minors…

With Covid raging on in America, people are losing their jobs and without any income, are losing the bank accounts adding even more to the Unbanked numbers!

In conclusion, you are able to determine for yourself how a REAL Bank Challenged™ number of 176 Million Unbanked / Underbanked people exist in America today.

Deposit & GO InstaDebit™ is here to remedy this 3rd world condition existing in America today!

Join us and let’s get to work!

S&P Global Market Intelligence

March 2021

There were a record number of bank branch closures during the pandemic in 2020, with banks closing 3,324 branches last year, according to a tally by S&P Global Market Intelligence.

SeeTek News

Nov 27, 20

SeeTek is proud to announce our latest offering, SWORD Sentinel™. We’d like to thank all our project partners in getting Sentinel off the ground in a mere 6 weeks!

With the Covid 19 virus front and center in people’s minds today and with the desire to return to “normal” lifestyles, the Sentinel will play a pivotal role in helping society deal with new threats while still allowing our freedoms not to be restricted to staying at home.

Stay tuned for more developments as we partner with other great solution providers!

SeeTek Eyes Events

Nov 22, 20

SeeTek is said to be looking at kicking off its new SWORD Sentinel™ project at several upcoming events across the nation.

New Strategic Partners

Nov 19, 20

The flood gates have opened up at SeeTek as multiple suitors court SeeTek. From hardware giants, software providers and industry Guru’s, top players look to dominate the Visitor Management market with their own version of the white labelled SWORD Sentinel™.

Sentinel and its line of satellite kiosks allow a safety net to been thrown over whatever venue that requires multiple levels of security all at one time, says SeeTek’s CEO Kerridge. Upon successful completion of a rigorous one minute registration process, from authenticating the user, their government issued ID, background checks and Covid temperature screen, a payment may be made and the user is presented with an RFID Photo ID Card allowing access to the venue and or multiple access points within the venue.

SeeTek Announces a New Role for SWORD Technologies

Oct 5, 20

Sensing an opportunity to send our patented bank technology in a new direction, Kevin Kerridge, CEO at SeeTek announced today that, “SeeTek will be entering the market with a new Covid 19 Solution designed to monitor and this slow the spread of Covid at Schools, Nursing Homes, Hospitals and other essential facilities.”

Our patented Scanned With Optical Recognition Devices, or SWORD technology, is capable of more than just on boarding new clients for a Bank or Credit Union, who have a more stringent on boarding procedure than TSA at the airports. SWORD maybe introduced into non financial markets to solve other challenges. SWORD was built to be flexible and thus function in any environment where a person wishes to enter, Kerridge went on to say.

SWORD Sentinel™ will leverage Artificial Intelligence to drive our Optical Character Recognition scanners, resulting in a quick, accurate authentication and data entry of a person and their documents. Adding a Covid temperature scanner and payment device will round out the offering while the mini satellite kiosks will play a supporting role at which ever venue Sentinel is installed.

AARP

Sept 2020

Financial Access Challenges for Older Adults

In 2017, an estimated 8.4 million households in the United States, representing about 14 million adults, had no checking or savings account at a bank or credit union.1 This figure includes roughly 3.5 million households headed by someone age 50 or older.2 When combining this population—often called the unbanked—with households that have accounts but still use some alternative services such as check cashers or payday lenders, these numbers rise to nearly 33 million households,3 a figure that includes 14.7 million households 50 and older. These major gaps in financial access demonstrate disparities that have become particularly troublesome during the COVID-19 pandemic. Those without bank accounts face added costs, risks, and obstacles in an environment where electronic payments take precedence over cash. Meanwhile, alternative sources of credit run the risk of trapping vulnerable borrowers deeper in debt.

Click to download the article

IBANYS President & CEO (66 member banks) gives a nod and shout out to SeeTek!!!

The President's Message:

IBANYS News and Updates

By John Witkowski, President & CEO

August 26, 2020

In just over one month, IBANYS will host our 2020 Virtual Annual Convention, which will be held September 30 - October 2.In the midst of the changes caused by the pandemic, our virtual convention is an innovative way for all of us at IBANYS to provide important and timely educational programming to New York community bankers -- just as we have always done in the past in our in-person programs. Please take a moment to read the many updates in today's newsletter about this new and exciting approach, learn how your bank can participate and be a part of this event in our new “normal”. We have information on topics, speakers, sponsorship opportunities and the opportunity for banks to make the virtual convention available to all bank employees. It's our way of continuing to provide the important information your banks need.

The Banking New York Magazine is reaching out to our industry leaders and partners asking you to nominate exceptional and qualified candidates for the New York Women in Banking Awards. Please take a few minutes to nominate a friend or colleague who you believe is deserving of being honored in our New York Women in Banking feature. Please click here to submit your nomination or view additional information.The deadline to submit your nomination is Thursday, September 4.

IBANYS newest endorsed vendor Bankers Healthcare Group (BHG) is pleased to invite you to an exclusive free meet & greet webinar on Wednesday, September 2nd at 10:00 a.m. ET

Meghan Crawford, SVP Bank Relationships will provide in depth details on how you can purchase high-quality loans using their state-of-the-art delivery platform, the BHG Loan Hub, designed for community Banks.

Click here to learn more and to register for the exclusive event.

Mark your calendars and registered today!! Don’t wait this is an outstanding opportunity to hear how you could grow your loan portfolio.

Here is a link to an article in Forbes on the unbanked and underbanked. The under-banked and un-banked population has always been an interesting question for banks. There are new ideas covered in this article to help 25% of the population have a bank account. While it's not mentioned in this article, IBANYS works with a company called SeeTek who has an answer to eliminating payday lenders and other high cost check cashing businesses. We are working with Kevin Kerridge, President and CEO of SeeTek to schedule a webinar for banks in NYS.Forbes.com Article -What Banking For The Unbanked Means For You click to read article

The FDIC's Quarterly Banking Profile reported that Community bank net income increased 3.2 percent in the second quarter from the same time last year.That contrasts with the overall banking industry's 70 percent decline in net income, due to the economic impact of the coronavirus pandemic. More than half of community banks reported higher net income despite a 273.2% increase in provision expenses. The increase was driven by gains on the sale of loans (up 142.2%) and securities (up 130.7%). Community banks reported year-over-year loan growth of 13.5%, driven by Paycheck Protection Program lending. The net interest margin for community banks decreased 17 basis points year-over-year to 3.51%, as the decline in average earning asset yields outpaced the decline in funding costs

- The Deposit Insurance Fund (DIF) balance rose $1.4 billion from the previous quarter to a record $114.7 billion. The reserve ratio declined 9 basis points to 1.30 percent due to an influx of more than $1 trillion in new deposits.

- During the second quarter, one new bank opened, 47 institutions were absorbed through mergers, and one bank failed.

Forbes

What Banking For The Unbanked Means For You

Jul 10, 2020

The COVID-19 pandemic has highlighted the plight of the unbanked and underbanked in America. For all of our progress as a nation over the past decade, more than a quarter of US households lack access to a basic bank account or other basic financial services.

Here is the Forbes.com Article on Unbanked discussed on our call:

https://www.forbes.com/sites/boblegters/2020/07/10/what-banking-for-the-unbanked-means-for-you/?sh=84bb4ac7325e

Or Click here to load the pdf.

2019

Why Remaining Demographic Agnostic Is Vital For Fintech In Payments Convergence

Shai Stern Forbes Councils Member

July 26, 2019

Despite mobile payments providers and credit cards, my mother and other members of the Silent Generation will continue to pay by check. Paper check remains the most common method of paying rent, even among millennials and Gen Z. Many medical bills, utility bills, taxes and nonprofit donations are also still made by check. On the business side, companies continue to pay vendors by check and accept check payments, alongside electronic methods.

Some financial technology (fintech) businesses have ignored check payments, focusing instead on card and mobile payment processing, and card companies that ignore cash and check are only touching a portion of payments. The most successful fintech providers are able to remain demographic agnostic and adapt to payments convergence by aligning their business to these three pillars: checks, Automated Clearing House/electronic and cards. To ensure these pillars function together, fintech companies should consider both integrated receivables and integrated payables to assist with all aspects of a payment from start to finish.

https://www.forbes.com/sites/forbesfinancecouncil/2019/07/26/why-remaining-demographic-agnostic-is-vital-for-fintech-in-payments-convergence/?sh=29c5c885539d

The Federal Reserve Payments Study: 2018 Annual Supplement

Check use up 7.5%

Debit card use up 10.4%

Prepaid up 10.5% which makes you ask...

Wouldn’t Debit be up 21.1% if people had access to a basic bank account?

INSTEAD of EXPENSIVE prepaid cards that were a grass roots payment solution BECAUSE there wasn’t any other choice AND Deposit & GO wasn’t available at time of study...

This brief provides 2017 national estimates and 2016 to 2017 growth rates for card payments. These estimates are based on survey data from a census of general-purpose card networks, payment processors, and issuers of private-label cards. The surveys covered four types of debit cards (non-prepaid, general-purpose prepaid, private-label prepaid, and electronic benefits transfer (EBT) supporting certain government assistance programs) and two types of credit cards (general purpose and private label).

This brief also provides new estimates of 2016 to 2017 growth rates for ACH and check payments as well as ATM withdrawals.

https://www.federalreserve.gov/paymentsystems/2018-December-The-Federal-Reserve-Payments-Study.htm

Click here to load the PDF.

National Alliance of Buy Here, Pay Here Dealers

National Independent Automobile Dealers Association

NABD/NIADA Newsletter Email

May 15, 2019-07-09

Leveraging Your Location with a FinTech

Feb 13, '19

I'm sure you've heard the term FinTech being thrown around lately in regards to tech giants Amazon, Google and how they might threaten the banks. Tech giants may affect the traditional bank space but does that really affect your non-traditional market space? Probably not, here's why and what you can do to leverage your dealership locations.

Banks have started to embrace FinTech's and their state of the art technology to help grow their footprint and offer "digital" services to their "bankable" clients. Retailers have started enhancing their locations with online delivery, pick up and financial services. But what about the auto dealer and their subprime customer? Chances are your dealership is located in a "Bank Desert". Bank Deserts have formed all over the US covering as much as one third to half of your State. Bank Deserts form when expensive traditional branches close due to a change in the neighborhood or a $3 million branch is just not viable to build. Or low to moderate income areas are redlined by the bank ie not enough income to support a bank branch. It's against regulations to redline addresses but the banks get caught doing it more often that you would think. The most telling feature of a Bank Desert are the number of check cashers, presently growing at 15-30%, as the bank move back into the cities. That doesn't mean Bank Deserts don't exist in cities. Most major cities have large pockets of low income people living in Bank Deserts. California has 5 of the top ten most unbanked cities in America and two more are runners up! The highest percentage of the Unbanked live in a large region of States from North Carolina through the entire South East and West across to California.

But what is a FinTech and how might it apply to your operation?

We've all heard the words, "Game Changer" before. Financial Technology (FinTech) companies developing state of the art bank and payment systems have been around for a while but are now just starting to make waves across many markets and concern in some. Recently the Banks themselves were terrified FinTech's would somehow impact their market. Then they embraced prepaid cards as a solution to servicing the subprime market. Prepaid cards are NOT bank products at all, far from it in fact! A new true bank product and delivery system was required.

Enter a FinTech which now offers mini bank branch terminals partnered with a bank in the same model as you would find an "Bank Branded" ATM in a retail store. The smaller POS footprint terminal banks anyone, "bankable" or the "unbanked" non-traditional subprime person we call "Bank Challenged"©. No or poor banking history, no or poor credit history, no questions asked, instant issue bank account with a Debit Card printed on the spot. And allows for automatic vehicle loan payments from the bank account that add up for you with no staffing or cash handling issues or long lines to be serviced on pay day! These are real "entry level" basic bank accounts not to be confused with non bank prepaid cards that are now rendered obsolete by this new bank product. This new mini bank branch opens your doors to become a Destination Dealership for banking and thus leveraging your location plus driving traffic and increasing vehicle sales! Put up your hand if you are selling too many cars... Put up your hand if you don't want a leg up on your competition!

And by the way, why are you letting your customers use a check casher when handling all that cash gives you a headache? Remember your Customer Service Course? Service, Service, Service ie customer contact w products your customer wants to buy! The check casher knows... now your dealership knows and you can compete!

Here's why you should be more than interested in Servicing your customers

Am I letting found money walk out the door?

What if there was a service that combined your $70 billion market share and yet captured some of the $68 Billion check cashing market AND other financial products your customer buys?

The subprime market you service is valued in excess of $325 Billion and yet buy here pay here auto dealers represent only about $70 Billion of that. And check cashers $68 Billion...

Said mini bank branch offers check cashing (deposit), with a financial product inventory that the subprime "Bank Challenged"© market would normally purchase elsewhere... well why not from you?

All the inventory items are electronic without any need for physical inventory. Money Remittance, Bill Pay, Cell Phone Top Up, eGift cards to name a few items. And every single purchase nets the dealership a revenue stream adding to your bottom line!

In the end, if you save your new customer the predatory fees that the check casher charges, 10% of their annual income ($2400-$4500)... didn't that just make their vehicle payments for the year? What did the check casher give them...?

Ride with Me & Bank for Free!© Could be your new campaign!

What other areas of your business can FinTech's assist in?

Having trouble with recurring vehicle payments?

Paper checks may be going the way of the dinosaur but don't kid yourself, 20 billion paper checks per year are still written and if not paper, electronic checks or ACH transactions count for another 24+ billion. Then there's the massive number of credit and debit card transactions... 47 billion debit transactions alone in 2012... many of these are recurring transactions. Sure that vehicle payment stream went well for a while and then those debits started bouncing. NSF payments are the bain of any Merchant. The over head to handle NSF payments is huge. Staffing, letters, legal and court time, the black holes of profit margins, sucking up cash and you probably don't even realize how much, until year end! Hopefully you do and there's a fix.

ACH NSF Electronic Payment recovery, falls under NACHA rules and regulations. NOT Check Collection Agent rules and regulations that employ antiquated, expensive methods and DO NOT recover recurring credit or debit charges commonly found in a buy here pay here contract. This means a new profit margin for your operation as you are NOT paying for Collection Agencies high fees ONLY to recover 50% of NSF items, the industry average, with 40-50% fee on top of that or .25 cents on the dollar back to you. NSF Electronic Payment Recovery services offer free recovery services, free web portal reporting, 70-90% of items collected, 100% of funds returned and electronically deposited into your bank account with free support for as long as you require!

Now take a moment, have a coffee and think about this... all electronic, no staff, 100% of recovered funds returned (not 25%) and 70-90% of items recovered (not 50%) and all other services included are FREE!

Equals "found money" by moving into the future!

How is that possible?

Some pretty smart FinTech guys with a fancy algorithm and state of the art computers!

Under NACHA rules for NSF Electronic Recovery Services, the company is allowed to present the NSF item more often than the bank and charge a State approved fee to the account holder on each NSF item. That's how the service is free to you... and the company makes a few bucks...

When's the last time you brought your POS card processing up to speed?

FinTech's are pushing change more often than you take your wife out on a date... unless you're "that guy".

Specialized Credit and Debit card processing for dealerships like you've never seen!

How about a free quote with aggressive rates even if other processors turn you down! And a comprehensive report of their rates...

But there's more! Free terminals, free support, free custom web portals with full reporting and no contracts!

The FinTech for you, crunches mammoth amounts of data and is laser focused on dealerships, the spin off information they can offer you is mind boggling. To get your business they are happy to Service, call it over Service, you!

What about a virtual marketing program that targets the shopping habits of your prospective clients via their cell phone with a text message within a defined geo-fenced area using Google Maps®? Sounds like Star Wars and you're not far off... but that's another entire story...

No matter what you do, you owe it to yourself to research what a FinTech can do for your operation to make it more streamline and ultimately more profitable than your Dinosaur competition will be down the street!

Drive your dealership into the future today with a FinTech and realize increased profits that impact your bottom line!

Mr. Kerridge is the CEO of SeeTek, LLC. Inventor and US Patent holder of SWORD® technologies.

More information may be found at https://buyherebankhere.com/

Buy Here Bank Here is a registered Trade Mark.

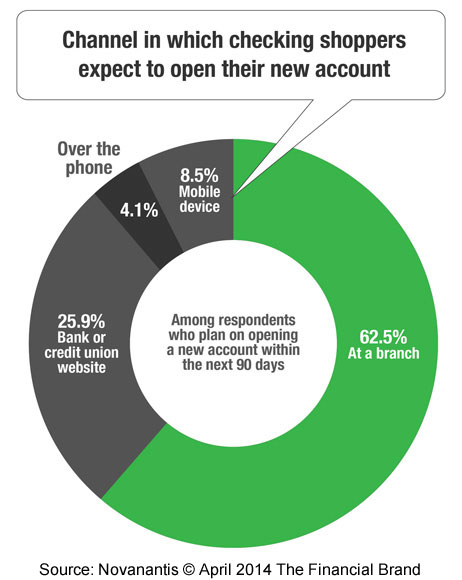

The people have spoken "Bricks not Clicks"™ to open a new bank account!

62.5% would rather open a new bank account at the branch with a person!

The SWORD Mini Bank Branch Terminal may be installed anywhere and everywhere!

2017

Why We Still Need Bank Branches!

By Chris Skinner

December 1, 2017

One, it supports a community and specifically the business community in the area. Businesses have different needs to consumers, and do often need access to a human. People forget that.

Two, money isn't the same as a Facebook update. If you lose a post saying what a nice time you're having, it's not the same as losing a deposit of $10,000. In fact, I often state that if you woke up today and find your bank app confirms the balance you expected, then you're happy. But how do you feel if the balance is -$10,000 short of what you expected? You're just going to sit and ignore it? Of course not – you'll call the bank or go to the branch to eyeball someone. This is because money is different; it's far more emotional than other parts of our life, because it's the controlling factor in our lives....Three, I think a lot of pundits forget what it's like to get your first job, first relationship, first car and first home. These are big moments in a young person's life, and to imagine they would all be dealt with through an app is a little bit strange.

Four, building on the last point, money is serious, critical and central to most people's lives, and needs a human interface. Sure, you can build the human interfaces into a Skype call, and we will, but removing the humanity and the human physical access from a service so fundamental to our lives is stupid. It demeans the role of the bank and banking, and is undermining the role this service has in people's lives.

[Need three more?]

Roberto Ferrari of digital bank startup CheBanca! in Italy articulated it most succinctly for me. When visiting his branch in Milan, I wondered why a digital bank had branches. He told me that it was for three reasons. The third is services, the second is trust, but the most important reason he gave me is marketing. His branch network was for marketing purposes.

Wow, that's a surprise, but I can see why. He told me that where the bank had a physical presence, they received two-and-a-half times more deposits and assets than where they did not. In other words, the bank that has a branch has far more chances of getting people's trust and money than those who do not.

https://banknxt.com/62230/still-need-bank-branches/

Raddon Reseach (a FiServ Company)

August 30, 2017

Mobile Bankers STILL want Branch Convenience!

The #1 Reason People Select a Financial Institution is Because of BRANCH Convenience!

78% of Mobile Bankers Live Near a Branch that's Convenient!

Mobile Banking Creates "Stickiness" Even if the Person Moves!

Find Out More. Watch the Video!

Bank Branches: Is The Writing On The Wall?

June 22, 2017

[Or... Mobile Bankings Rush to Fill the Bank Desert Void? Not so Fast! At Least Here in Traditional America...]

In a counter to sluggish interest rates, ever more complicated and taxing compliance regulation, and a weakened consumer market segment, bank executives across North America and Europe are taking the ax to "superfluous" brick-and-mortar bank branches.And while macro-economic factors, most of which represent the residue of the 2008 financial crisis, certainly led banks to water, a meaningful transition to digital channels requires a critical mass of customers willing to migrate to mobile or desktop banking in lieu of more traditional means.

Facts On The Ground

The last few years have bore witness to a somewhat jarring pace of bank branch closures,and the process has morphed from 'pruning' excess to deep cuts in infrastructure. Since 2012, JPMorgan Chase has trimmed national network coverage by 9 percent, while Bank of America has pursued a more aggressive strategy, shuttering the equivalent of 15 percent of its brick-and-mortar posts.

...Even Wells Fargo, which had been a last stand of sorts and resisted the urge to shrink network footprint, intends to close shop at 400 bank branches by 2018, on top of the 68 locations deemed redundant and unnecessary in 2016. And while the company claims this is a calculated move that merely reflects surging demand for online banking, Wall Street analysts have quipped doubts, and speculated that the fake account scandal may have forced the bank's hand.

Knock Knock. Who's There?

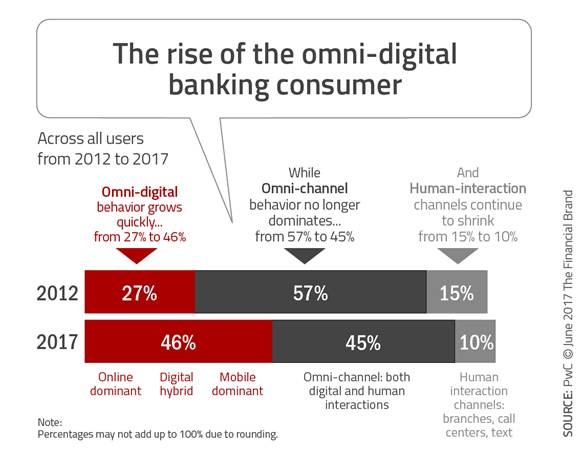

Children jokes aside, a little bit of due diligence can shed light on consumer behaviors and expectations - a first step in evaluating the life expectancy of branch banking. In the United States, alone, opinion has shifted from an openness to dabble in digital channels to an active embrace of it over the course of the last five years. Users are nearly twice as likely to engage financial institutions from wholly digital mediums now - whether that be mobile, desktop, or a combination of the two - than they were in 2012.

However, banks must not be so hasty to conclude, then, that it is open season on branch networks. Within that very same PwC survey, another nugget of information reflected the nuanced nature of consumer psychology. A majoritarian 62 percent believed that a grass-root, local presence was still necessary.

When overlaid with age, race, or socioeconomic distribution data, bank branch closures in the United States, too, become fraught with ethical asterisks. Indeed, network reductions disproportionately impact the elderly, poor and minority communities. The abandonment by banks of less affluent consumer segments has, in part, helped ignite the firestorm of predatory payday lending, which often relies on storefronts in under-served neighborhoods.

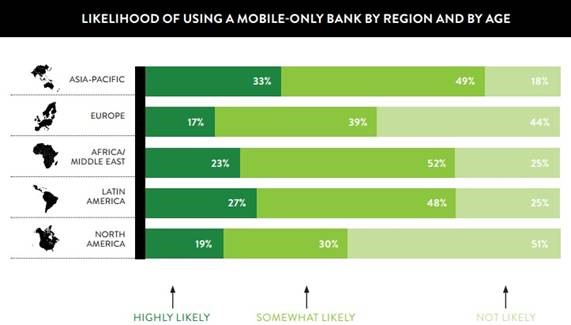

Ironically, while brick-and-mortar is more likely to be the banking vehicle of the poverty-stricken in North America and Europe, in Africa, Asia and beyond, it is through digital finance (or to be more precise, usually mobile money) that most are thrown a line to financial services.

Across the board, receptivity to - or at least consideration of - a variety of mobile-based transactions is far more entrenched in Africa, Asia-Pacific and Latin America. With the exception of the use of mobile payments in bars, restaurants or retail, European and North American respondents were much more resistant to mobile payment use cases than their African, Asian and Latin American counterparts - exemplified by the larger percentage of "not likely" segments. These mentalities, then, would presumably extend or bleed into comfort levels on mobile-only banking. If a user is amenable to conducting other sorts of financial activity digitally, it seems reasonable that banking would not be singled out as an exception.

Source: The Nielsen Mobile Shopping, Banking and Payment Survey Q1, 2016

This intuition appears to be reinforced by the data. The percentage of survey participants that fall into the "somewhat likely" or "highly likely" category, and would debate enrollment with a mobile-only bank, teeters around the 75 percent mark for Africa and Latin America, and topples the 80 percent mark in Asia-Pacific.North America, conversely, is just shy of 50 percent, and the plurality is not keen on the concept of a mobile-only bank.Europe, while marginally better, still barely exceeds 50 percent.

Moving Forward Is Not A Straight Line

Although most emerging markets are still in the midst of a slow, gradual brick-and-mortar bank branch build-up, over the long-term, the conditions seem more favorable to side-step physical networks. Consumers in these markets have had consistent doses of digitized financial services, which in many cases, was the first exposure to formal banking.

The same does not quite hold true in North America and Europe.Digital finance may be an unintentional culprit in further isolating vulnerable pockets of people from reputable financial institutions. Therefore, if branch closures are to continue unencumbered, digital finance needs to better involve those on the margins of finance - it cannot be a mechanism that simply filters them out.

On top of that, there are still roadblocks to consumer acceptance. Perhaps banks need to better advertise benefits or design incentive systems to help motivate a proverbial "toe-in-the-water" moment for digital banking. Some possible premiums or points of emphasis might include lower fees on investment products, discounts on lifestyle activities through retail partnerships, higher deposit interest rates, lower lending rates, or exponentially quicker turnaround time on transactions.

Even with an uptick in digital banking, though, the brick-and-mortar branch will probably evolve before it evaporates. Already, there are precedents of banks leveraging parallel networks to 'fill-in' and offer basic, popular in-person services. In 2012, most banks in the United Kingdom had opted into an agreement with the Post Office which allowed customers to deposit and withdraw funds at the 11,500 post office locations nationwide, in addition to cursory checking of account balance.

So, are we entering the dark days for branch banking? Dark days is too extreme, and dog days might be a better description.While brick-and-mortar banking is certainly at a crossroads, and its utility is becoming hazier or even lethargic and without innovation, its existence - in totality - is not really up on the chopping block.

© Mondato 2017

Banks could lose 60% of retail profit to tech startups: study

Globe & Mail

David Berman, BANKING REPORTER

March 25, 2017 September 29, 2015

Banks could lose up to 60 per cent of their retail profits to nimble fintech firms within the next decade, according to global consultancy McKinsey & Co., offering a particularly alarming outlook as new financial technology players nibble away at some of the more vulnerable areas of traditional banking.

The consultancy said that altogether banks are producing profit of some $1-trillion (U.S.) globally, providing a powerful incentive for startups to grab even a thin slice of that business with cheaper or more convenient services. Given that the number of startups is now estimated at 12,000, these slices can add up to a major threat.

https://www.theglobeandmail.com/report-on-business/fintech-startups-pose-threat-to-traditional-banks-retail-profit/article26587892/?ref=http://www.theglobeandmail.com&

Adults Don't Use Mobile Banking

While mobile banking app use took off in 2015, with member adoption of credit union apps growing by 35 percent on average, nearly 88 percent of U.S. adults did not use mobile banking because they felt their needs were being met without it.1

1 Source: https://www.statista.com/statistics/244250/reasons-why-us-users-didnt-use-mobile-banking-services/

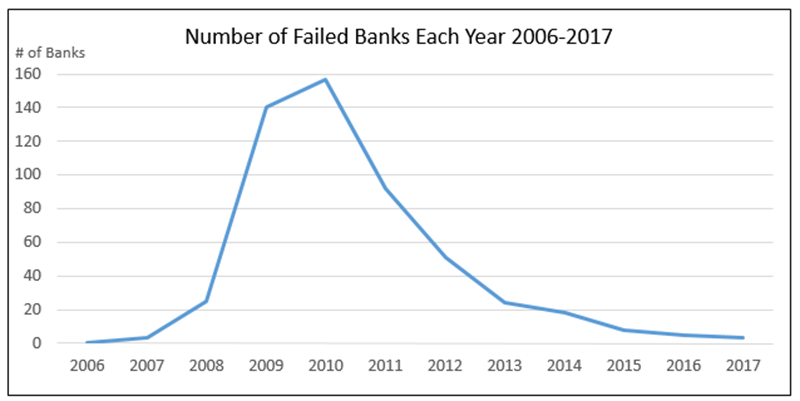

Bank Failures Since 2009

There are bank closures... and then to make matters worse... there are bank failures...

| Year | Bank failure cost to DIF | Number of bank failures Total: 491 |

|---|---|---|

| 2016 (estimated) | $9.6 million | 1 |

| 2015 (estimated) | $894 million | 8 |

| 2014 (estimated) | $398.8 million | 18 |

| 2013 (estimated) | $1.165 billion | 24 |

| 2012 (estimated) | $2.785 billion | 51 |

| 2011 (official) | $7.945 billion | 92 |

| 2010 (official) | $22.904 billion | 157 |

| 2009 (official) | $38.732 billion | 140 |

2016

Payment Journal

August 23, 2016

Trend is consistent with Mercator Advisory Group Banking Channels research, which has found that customers and members strongly desire the option of having face-to-face contact at a branch -- when and where desired. This access to subject matter experts, even if only agree occasionally, can be an important driver of customer satisfaction and increased product deepending and long-term loyalty.

Bank executives argue, however, that branches remain crucial for acquiring new customers and doing more business with new ones. Closures, they say, would hurt revenue more than help reduce costs.

“Our customers still want to visit us,” Jonathan Velline, Wells Fargo's head of ATM and store strategy, told Reuters in an interview. “They're still coming to our stores and our ATMs at pretty consistent rates.”

Washington Post: Say goodbye to your neighborhood bank branch

Former Barclays chief executive Antony Jenkins laid it out in particularly stark terms in a speech last fall: The global industry, under pressure to meet customer demands for automation and cheaper services, will slash employment and branches by 20 percent to 50 percent over the next decade, he estimated.

“I have no doubt that the financial industry will face a series of Uber moments,” he said in the late-November speech in London, referring to the way that Uber and other ride-hailing companies have rapidly unsettled the taxi industry.

And that's not just the opinion of one well-informed man.

Francisco Gonzalez, CEO of BBVA Bank, said about “In 10 years, only 100 banks will have survived the digital wave.”

Realize these figures and representations are indicative of the "banked market" who have the education and unlimited access to online banking technology and therefore need not frequent a bank branch as a "bank challenged" person would have the need to. As proof of that, Check Cashers "thrive" in "Bank Desert" regions. Growing at a rate of 11% in 2014.

Life in a Banking Desert

Without access to basic financial services, poor and minority communities are more likely to use dangerous, high-cost options.

Mar 2016

A neighborhood saturated with fast-food restaurants and bodegas but lacking a grocery store would make it difficult to stick to a healthy diet. It would be similarly hard to manage finances and build wealth without a bank branch nearby. Unfortunately, that is exactly what an increasing percentage of U.S. households are being told to do: manage their finances and build wealth without access to a nearby mainstream bank branch.

This does not mean, however, that the evidence couldn’t be used to draw mixed conclusions. The New York Fed reports that lower-income communities and communities of color have been less affected than higher-income and majority-white communities by bank branch closings that occurred in the shadow of the Great Recession. However, these communities had less to lose to begin with. Lower-income communities and communities of color have been experiencing a shuttering of bank branches for nearly two decades—devolving into “banking deserts” for quite some time.

Federal deregulation in the 1990s allowed banks to pivot from primarily serving local communities to serving larger and more profitable geographic regions. Banks withdrew from local communities, closing their less-profitable branches that were often in lower-income communities and communities of color. High-cost alternative financial services began to occupy the communities once served by mainstream banking services, expanding at a rate of 15 percent per year since the 1990s.

When alternative financial services like payday lenders and check-cashing stores—the equivalent of fast-food chains and convenience stores in this scenario—swoop into neighborhoods left behind by mainstream banks, residents pay a steep price to meet their financial needs: The average borrower spends over $500 a year in interest just on payday loans. Residents end up diverting money that could have otherwise been used to pay for irregular expenses or to build wealth, instead paying to use the basic financial products that they so desperately need to manage their financial lives. Because like convenience stores in food deserts that don’t sell nutritious food that promotes good physical health, alternative financial services don’t sell products that build long-term financial health.

Technology like mobile banking and fintech innovations help close the geographic distance between households and brick-and-mortar bank branches, thereby increasing access to basic financial products. Yet technology alone cannot repair the negative impact that bank branch closures have had on mortgages and small business lending. Simply put, brick-and-mortar bank branches still matter for accessing credit to build wealth. Without a bank branch in their community, households have limited access to safer and more affordable products, like a savings account that could be used to pay for irregular expenses, or to invest in the future. And, as the New York Fed’s study indicates, residents lose access to small business loans and mortgages when bank branches close, hindering the investment and entrepreneurship needed to drive local economic growth.

https://www.theatlantic.com/business/archive/2016/03/banking-desert-ny-fed/473436/

2015

Biz Journal: More than 1,600 bank branch closures in the U.S. last year

Overall, there are 1,614 fewer bank branches in the United States today than there were a year earlier [2015]. Banking companies of all sizes continue to close offices as more consumers turn to digital banking and as a means to trim expenses. [Note many low income people do not have access to the digital world. They may be older, not trained or, according to AARP studies, just not be able to afford PC's, lap tops and smart phones. Having said that, to be fair and balanced, we have witnessed many homeless people with state of the art smart phones!]

https://www.bizjournals.com/buffalo/news/2016/01/15/report-more-than-1-600-bank-branch-closures-in-the.html

2014

Wall Street Journal: The number of U.S. bank branches has fallen to the lowest level since 2005

The number of branches in the U.S. dropped to 94,725 as of June 30, [2014], down 1,614, or 1.7%, from a year earlier and down 4,825 from the peak in 2009, according to the FDIC data.

https://www.wsj.com/articles/bank-branches-in-u-s-decline-to-lowest-level-since-2005-1412026235

NY Times: Criticism Grows as Check-Cashing Stores Expand in Poorer Areas

By WINNIE HU AUG. 5, 2012

Many of New York City's poorest residents do not have bank accounts, so these window transactions, repeated hundreds of times every day, are their primary contact with the financial system. Check cashers are as familiar to them as corner bodegas, and as reliable.

But an industry built on mutual convenience has come under increased scrutiny over the past decade as its stores have continued to become full financial centers, improving services like electronic bill payment, wire transfers and prepaid debit cards.

The expansion has spurred renewed criticism from advocates for poor residents and from bank officials, who say the check-cashing industry takes advantage of those who have no other options, and it has prompted more calls for consumer protections. Many of the industry's leaders say that they have been unfairly tarnished, that they provide needed services and that they are making improvements to their operations.

https://www.nytimes.com/2012/08/06/nyregion/as-check-cashers-expand-services-in-poorer-areas-criticism-grows.html